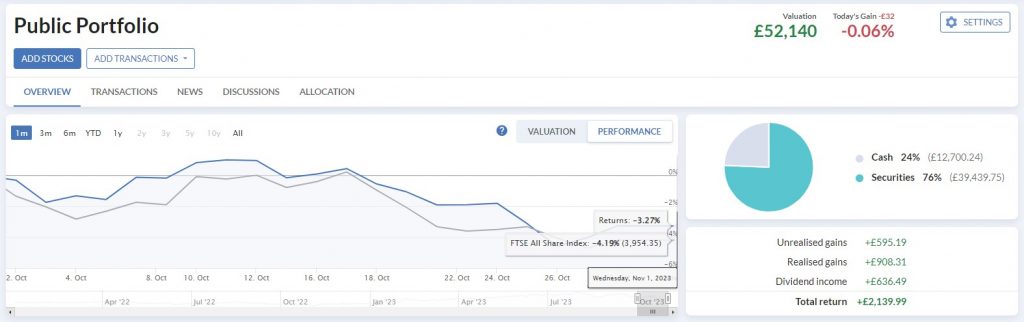

October was a challenging month. On the whole most of the stocks in the portfolio held up reasonably well, though there were a few that took a kicking. Luckily I sold them when they hit their stops so damage was limited. Still, a negative 3.27% for the month of October is not something I want to repeat that often. However the portfolio is still up 6% year to date, so I guess that’s a win of sorts.

I go through my buys, sells and the charts for all of my current holdings in the video above. So please check that out if you want more detail. Here I’ll just have a bit of a ramble.

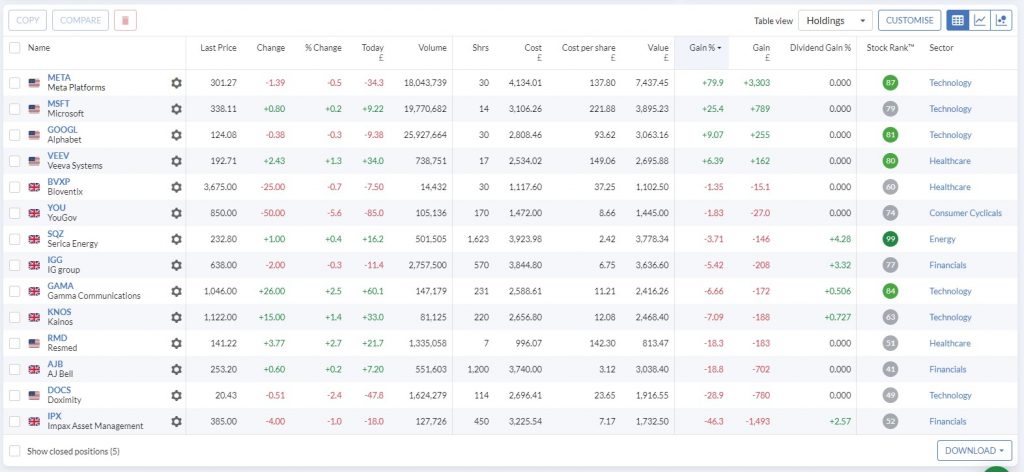

My Current Holdings:

For the past couple of months I’ve really been trying to improve my entry and exit strategies. One of the things that’s hurt my returns the most over the past three years is trying to catch a falling knife and averaging down. And at the other end of the spectrum, making a lot of profit on paper, but not taking it and watching the share price come all the way back down, even into a loss at times. When this has happened it has been so incredibly frustrating! The checklist process has helped a lot, in that I’m only buying high quality stocks now, but as the markets have proven over the past couple of years that’s no protection against market volatility. So I’m looking to create a hybrid strategy of investing & trading. Let’s call it the hybrid build.

I’ve read a few books on trading, but I’m certainly not a day trader, so many didn’t really speak to me. Until that is, I read Stran Weinsteins ‘Secrets For Profiting In Bull & Bear Markets’. For me his strategy just made sense and fit in with my existing investing style. The main thesis is using four stages to clearly define when you should be buying and selling and the use of a very simple 150 day moving average to time your entry and exits. I thoroughly recommend this book to anyone, I’ve read it through twice now. Though just be aware if listening to it you’ll want to be at a screen to see the accompanying pdf, I tried listening in the car and couldn’t follow what was going on as it’s very chart based.

So now I have a new strategy, or I should probably say a tweaked strategy. I still develop my watchlist in exactly the same way, looking at the fundamentals of a business and using my checklist. Though now instead of simply buying under my valuation line I will wait for a clear sign of a bottom and not build a full position until the price is above the 150 day moving average. I also now impliment trailing stop losses to reduce downside risk and make sure I lock in profits. There’s a bit more to it than this, but thats the jist. I’ll likely do a more in depth post about it soon.

Anyway I feel extremely confident with this new system and feal at ease knowing I’m not going to get myself in a position of having 50% plus losses on a stock any more, or letting all those profits on a position disappear. For those wondering, these 50% plus losses are from stocks I purchased before I developed the checklist system and the public portfolio. I still hold a few of these ‘trouble’ stocks but I don’t include them in the public portfolio, purely because they have no correlation with my current strategy and I want to see the returns my current strategy can give, not diluted by questionable past decisions.

Moving on, November has started well, might we be at the start of a new up trend in the markets? No Phil, don’t get too excited. Though I think there is a chance that we are, as it looks like peak interest rates may be in. Add to that a lot of stocks are at incredibly cheap valuations, especially in the UK and I’m not sure there’s much downward pressure left. Anyway it will be whatever it is, I’ll be here when the next bull run starts. Having only started investing in individual stocks in 2020 all of these market cycles are new to me, so it’s very much a time to learn and not make too many, if any, assumptions. If I can close out the year with a positive return for the portfolio I think I’ll be happy, it’s been a difficult year, especially in the UK, which seems to be out of favour with many investors.